nc sales tax on non food items

The state sales tax rate in North Carolina is 4750. As a business owner selling taxable goods or services you act as an agent of the state of North Carolina by collecting tax from purchasers and passing it along to the appropriate tax authority.

Pin By Xinedonovan On 2021 Tax Receipts Card Holder Credit Card Cards

Consumer means an individual who acquires qualifying prepared food or beverages for the individuals personal consumption or use or for the.

. While North Carolinas sales tax generally applies to most transactions certain items have special treatment in many states when it comes to sales taxes. Sale and Purchase Exemptions. North Carolina has recent rate changes Fri Jan 01 2021.

The state sales tax rate in North Carolina is 4750. We include these in their state sales. Is HST charged on take out food.

A 200 local rate of sales or use tax applies to retail sales and purchases for storage use or consumption of qualifying food. This document serves as notice that effective January 1 2009 there is a new exemption from State sales and use tax for bakery items sold without eating utensils by an artisan bakery. Tax Treatment of Food US.

A system of sales tax exemption would save nonprofits time and reduce administrative burdens. The 475 general sales rate tax plus local tax is charged on non-qualifying food which includes prepared foods and beverages in restaurants dietary supplements food sold through vending machines bakery items sold with eating utensils soft drinks and candy. California 1 Utah 125 and Virginia 1.

B Three states levy mandatory statewide local add-on sales taxes. Sales by non-profits conducted annually for. The North Carolina state sales tax rate is 475 and the average NC sales tax after local surtaxes is 69.

Options for Taxing Food and Prepared Food FY 2010-11. S346 would replace the nonprofit sales tax refund system with sales. Arkansas Grocery items are not tax exempt but food and food ingredients are taxed at a reduced Arkansas state rate of 15 any local rate.

The transit and other local rates do not apply to qualifying food. Lease or Rental of Tangible Personal Property. The North Carolina state sales tax rate is 475 and the average NC sales tax after local surtaxes is 69.

This means that depending on your location within North Carolina the total tax you pay can be significantly higher than the 475 state sales tax. Sales and Use Tax. Select the North Carolina city from the list of popular cities below to.

Non-Qualifying Food Dietary Supplements Food Sold Through a Vending machine Prepared Food Certain Bakery Items Soft Drinks Candy. Counties and cities in North Carolina are allowed to charge an additional local sales tax on top of the North Carolina state sales tax. Overview of Sales and Use Taxes.

Sales and Use Tax. Laundries Apparel and Linen Rental Businesses and Other Similar Businesses. Under current law charitable nonprofits in North Carolina pay sales and use tax on their purchases and can apply for semi-annual refunds of the taxes they pay.

Groceries are generally defined as unprepared food while pre-prepared food may be subject to the restaurant food tax rate. Goods sold by artisan bakeries without eating utensils are considered non-taxable at the state level though they are subject to the 2 local sales tax just like groceries. With local taxes the total sales tax rate is between 6750 and 7500.

Food Non-Qualifying Food and Prepaid Meal Plans. You can find more examples of when prepared food is and is not taxable in Section 32 of the latest North Carolina Sales and Use Tax Bulletin. This would include the County tax paid for the 2 Food tax as well as the 05 Transit Tax.

The 475 general sales rate tax plus local taxes including the transit and Article 46 sales tax are charged on purchases of non-qualifying food The reduced 2 local tax rate is charged on qualifying food which includes groceries and bakery items sold without eating utensils. Two levy the full rate. Who Should Register for Sales and Use Tax.

These categories may have some further qualifications before the special rate applies such as a price cap on clothing items. Top Are drop shipments subject to sales tax in North Carolina. Arizona grocery items are tax exempt.

Sales Tax Treatment of Groceries Candy Soda as of July January 1 2019 a Alaska Delaware Montana New Hampshire and Oregon do not levy taxes on groceries candy or soda. Currently combined sales tax rates in North Carolina range from 475 percent to 75 percent depending on the location of the sale. Below are weblinks to information regarding direct pay permits.

North Carolina has a 475 statewide sales tax rate but also has 459 local tax jurisdictions including cities towns counties and special districts that collect an average local sales tax of 222 on top of the state tax. This page describes the taxability of food and meals in North Carolina including catering and grocery food. The claimant should enter the total County sales and use tax paid during this period directly to retailers on purchases in the County column.

Search local rates at TaxJars Sales Tax Calculator Any food items ineligible for the reduced rate are taxed at the regular state rate. To learn more see a full list of taxable and tax-exempt items in North Carolina. Sales of these items will be subject to the 2 local rate of.

Food Non-Qualifying Food and Prepaid Meal Plans. 92 out of the 100 counties in North Carolina collect a local surtax of 2. The sale at retail and the use storage or consumption in North Carolina of tangible personal property certain digital property and services specifically exempted from sales and use tax are identified in GS.

Prepared food and soft drinks from restaurants and bars are taxed at the 475 General State rate and applicable local rate and transit rates of sales and tax. 200 200 200 512 575 287 000 250 500 750 Tax at Full Rate Include All Food in State Base Include All Food in State and Local Base Local State. Under current law charitable nonprofits in North Carolina pay sales and use tax on their purchases and can apply for semi-annual refunds of the taxes they pay.

Sales Tax Treatment of Groceries Candy Soda as of July January 1 2019 a Alaska Delaware Montana New Hampshire and Oregon do not levy taxes on groceries candy or soda. If both exempt and non-taxable items are being shipped together the percentage of the shipping charge that relates to the taxable items must be taxed. There are special instructions with Line 3 which specify which taxes should not be included on Line 3.

Just enter the five-digit zip code of the location in which the transaction takes place and we will instantly calculate sales tax due to North Carolina local counties cities and special taxation districts. At a total sales tax rate of 675 the total cost is 37363 2363 sales tax. Essentially the vast majority of items shipped in North Carolina have shipping costs which are taxed.

64 Dollar Grocery Budget Harris Teeter Grocery Budgeting Harris Teeter Budget Food Shopping

How A Taxpayer May Obtain A Sales Tax Refund Zip2tax News Blog Tax Refund Sales Tax Refund

Is Food Taxable In North Carolina Taxjar

North Carolina Sales Tax Rates By City County 2022

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

Sales Tax On Grocery Items Taxjar

Is Food Taxable In North Carolina Taxjar

States With Highest And Lowest Sales Tax Rates

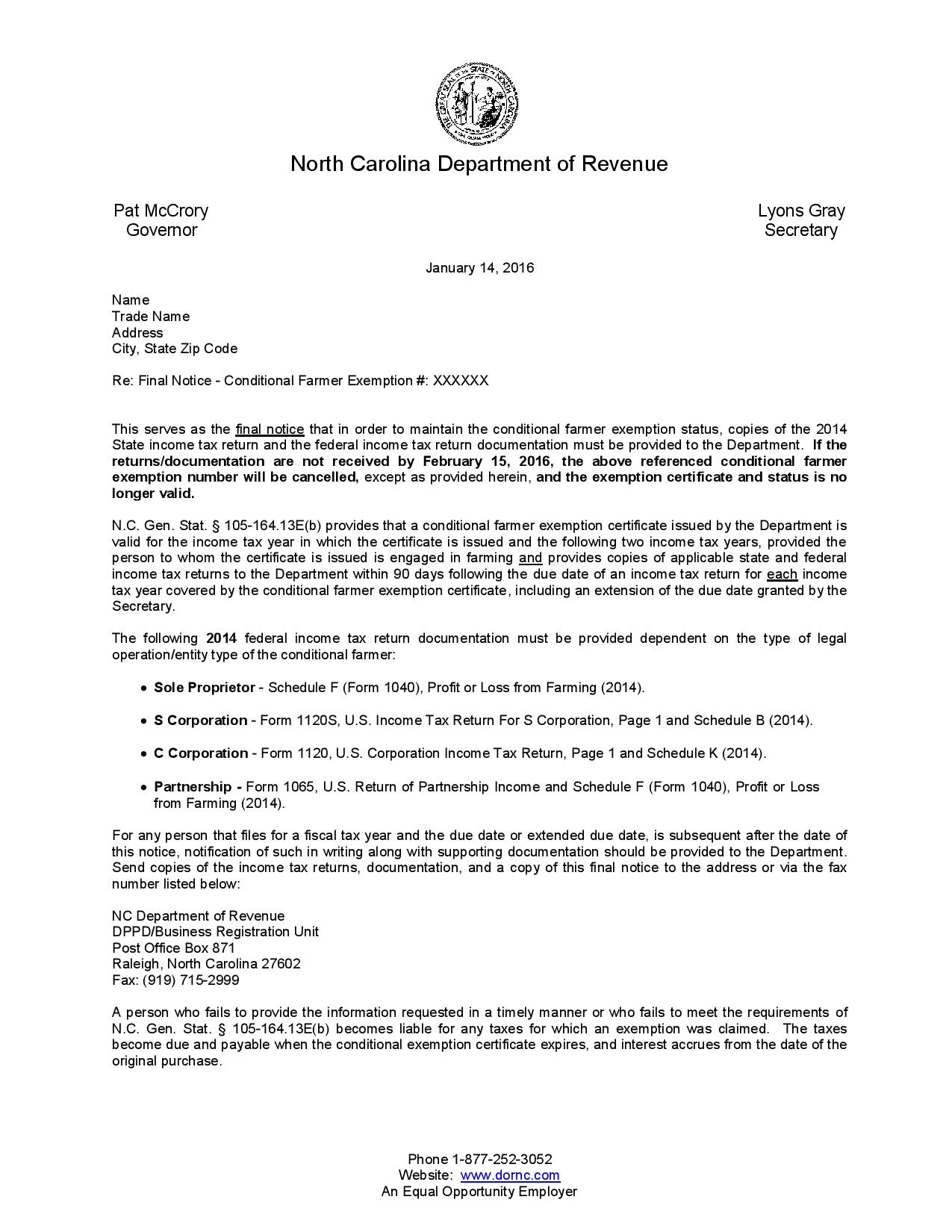

Sales Tax Exemption For Farmers Carolina Farm Stewardship Association

Is Food Taxable In North Carolina Taxjar

Is Food Taxable In North Carolina Taxjar

North Carolina Sales Tax Small Business Guide Truic

Sample Restaurant Inventory Template

See Which States Do Not Have Income Tax Sales Tax Or Taxes On Social Security Start Packing Income Tax Tax Sales Tax

Non Conformance Report Template Report Template Business Template Word Template